The third element, the scramble for lithium

A bit about lithium and lithium batteries

Lithium is about to change the world. Technology and modern lifestyles have created an insatiable hunger for energy. Energy to fuel our civilian transportation systems, to power our industries, our homes and especially our national defense infrastructure as well as weapons of war. Armoured fighting vehicles, jets, ships, and rockets all require vast amounts of energy to operate. Most of this energy is currently extracted from burning fossil fuels like coal, petroleum and natural gas. Indeed, energy needs have fueled many a conflict around the world, especially in oil rich countries. This has been so for decades, but as demand and consumption grew, the world quickly learned two things;

- That fossil fuels are harmful to the planet as burning them dumps vast amounts of carbon dioxide into the atmosphere, driving global warming and extreme whether events as the climate changes.

- That fossil fuels are a finite resource, and at the current rates of extraction, it is expected that oil will be depleted in about 50 years, 53 years for natural gas and circa 114 years for coal.

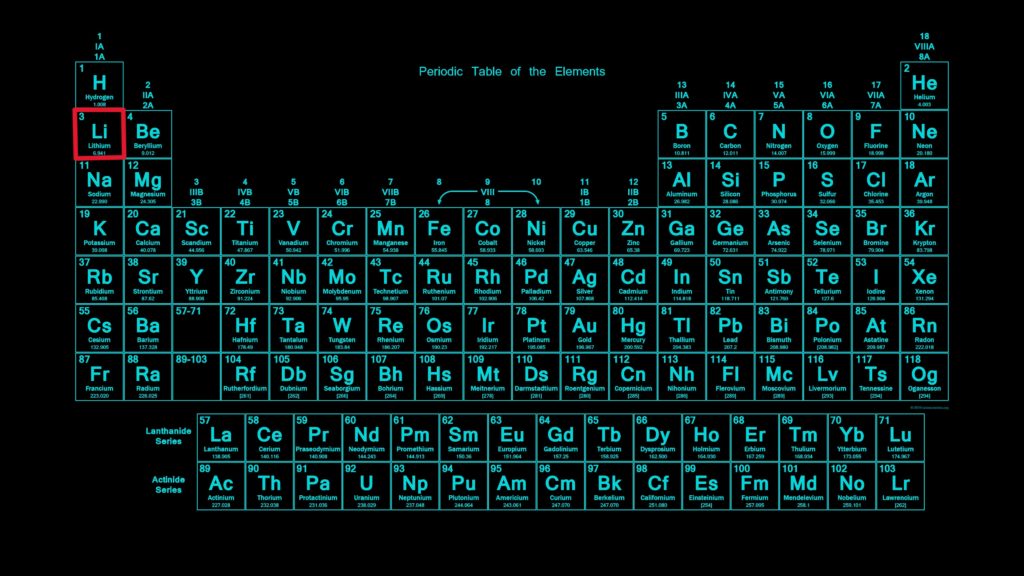

What this means is that new ways to generate and store energy become critical as the world transitions away from traditional energy sources to newer more environmentally friendly ones, and this is where the third element comes in. Lithium is a soft metallic element which readily and explosively reacts with water. It is so soft that you can cut it with a pair of scissors. Being the third element on the periodic table, it is very light – in fact it is the lightest metal, so light that even the oxygen we breathe is heavier than lithium although, of course, at room temperature, lithium is a solid so do not expect to see it floating in the air. However, its low weight is one property that makes it ideal for making portable batteries as it has a high charge-to-weight ratio compared to other metals. Additionally, lithium batteries charge faster and last longer. They are stable and can be good for as many as 5,000 charge cycles if well cared for.

The blessing and curse of white gold

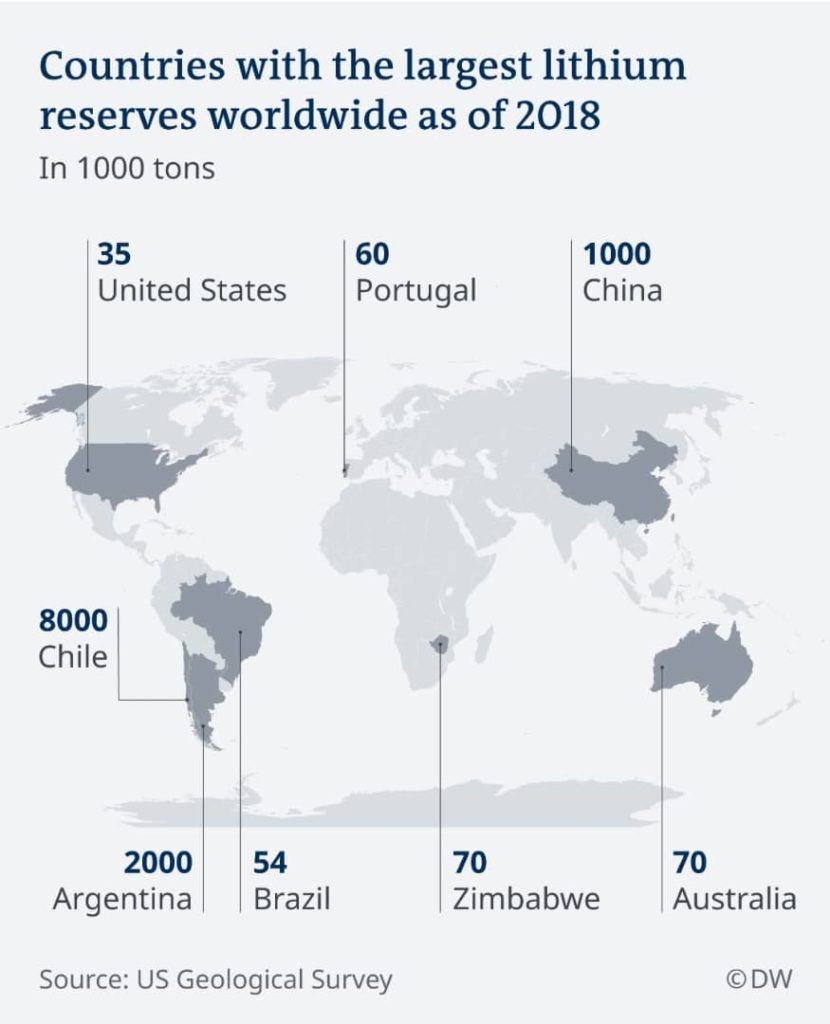

Now that we have a fair understanding of why lithium is a good candidate for high quality batteries with a good charge-to-weight ratio, we need to examine why this metal is both a blessing and a curse for Zimbabwe. First, we have a lot of it, we have so much of it that we are currently the sixth largest supplier of lithium to the global market, with potential to meet a fifth of global demand for several decades. Zimbabwe has the largest known reserve of lithium on the African continent, it also has the single largest known concentration of lithium in the world somewhere in the Bikita district of Masvingo province, and everybody wants it. If managed well, this will be a multi-billion dollar industry for the country. Secondly, given the future importance of lithium as electric vehicles rapidly replace petroleum powered vehicles, lithium, euphemistically referred to as white gold, immediately becomes a strategic mineral, and this comes with the attendant political implications. Whomever has the most leverage on the government in Harare, has access to the country’s massive lithium deposits. In this regard, Zimbabwe’s political landscape is of interest to China, the United States, Europe and Russia. Perhaps this is another reason that there is so much interest from the West as to who forms the next government in Zimbabwe. These economic and political power blocs want preferential access to lithium, which right now, China, having invested millions, has better access to.

Power bloc foreign policies positions on Zimbabwe

If there is one thing about the United States, it is that it is relentless in the pursuit of its interests. It has enjoyed the power to impose its unilateral coercive measures on other countries for more than half a century now. Through weaponisation of the reserve status of its US dollar, it has been able to exercise long arm jurisdiction over other countries by imposing or threatening sanctions on governments that do not yield to its policies. Ever since the fast-track land reform program undertaken from the year 2000, Zimbabwean interests have remained under sanctions imposed primarily by the US, and supported by the UK, EU and other Western powers. The United States renews its Zimbabwe sanctions annually, and has given various reasons for the sanctions extensions but consistently says, “the actions and policies of certain members of the Zimbabwean government undermined Zimbabwe’s democratic process posing an unusual and extraordinary threat to the United States foreign policy.” It begs the question, what extraordinary threat could a small, non-nuclear state like Zimbabwe pose to the United States? Even Vermont, the smallest of the 50 state economies making up the United States of America, is larger than Zimbabwe’s own economy. One can only conjecture that the precedent threat of land reform and the risk of Zimbabwe continuing to prefer selling its lithium to China and Russia are the “unusual and extraordinary” threats to the US but also, moves by the government to encourage migration to a gold backed domestic currency directly threaten the fiat dollar. And with Saudi Arabia, which has buttressed the petrodollar since the 1950s, beginning to lean away from America and towards BRICS, US influence is waning fast. In that regard, even tiny countries like Zimbabwe will not easily be allowed to set a precedence for others to follow. If one considers that lithium is the “oil” of the future, this Southern African nation should expect more interference from the United States. Of course, this is not to say that lithium generates it’s own energy, but that it will now be a critical component in powering the next world. It’s already in our mobile phones, laptops, and electrical vehicles, to name a few.

How real is the threat of US interference in Zimbabwe?

The United States has been unrelentingly focused on Zimbabwe since the fast-track land reform program at the beginning of the century. For more than 20 years, they have revised and renewed regimes of sanctions on the country, and although they have continued to provide humanitarian assistance through various aid agencies, they have also tacitly supported an agenda to change the political administration in Harare. Their ends are obviously to advance their own interests and those of their allies. One cannot blame them for behaving in this manner, because this is what governments are elected to do – to advance national interests.

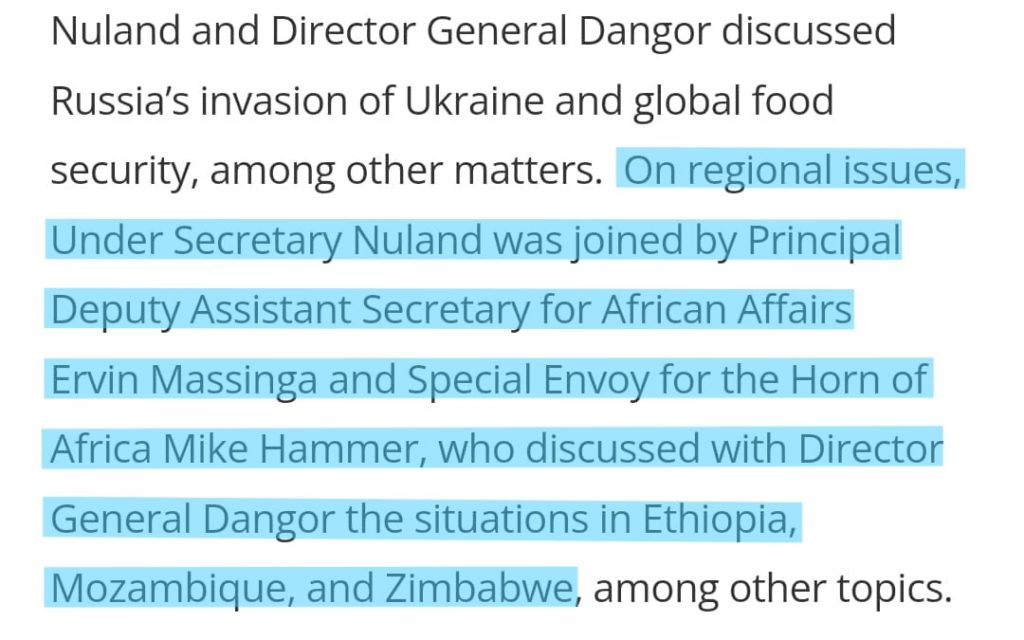

Recently, reports have emerged that the US Under Secretary of State for Political Affairs, Victoria Nuland, convened a meeting with other stakeholders where Zimbabwe was discussed among other issues such as the war in Ukraine and the situation in the Horn of Africa. Unless you consider that sanctions are acts of foreign aggression, Zimbabwe had no business being discussed among nations at war. However, it is noteworthy that Under Secretary Nuland has previously been accused of having meddled in Ukraine , with the assistance of the CIA, ahead of the coup that overthrew the Russian leaning government in Kiev. That coup, is blamed by historians for spawning the conditions that led to the eventual Russian invasion of its neighbour in February 2022. It should therefore be of concern to Zimbabwean authorities that the same Nuland is now targeting Zimbabwe, along with other nations which are viewed as being led by a “disobedient” governments that have so far refused to yield to the will of the United States.

In the end . . .

It remains to be seen how relations will develop between the two nations, Zimbabwe and the US, but learning from history, the US is unlikely to let-up on its regime of sanctions until there is capitulation from the lesser power or a change in government to one that is more Western leaning. Preferential access to the large lithium resource in the country will remain an incredibly important aspect of the dynamics that will impact the nature of the relationship. The Zimbabwe government’s decision to ban exports of raw lithium except under special exemptions and to encourage the manufacture of batteries in-country, since all the five key raw materials for lithium batteries are found in the country, could drive prices by increasing costs for electrical vehicle manufactures. Land reform was another precedence that risks upsetting the world order and has been severely punished by the collective West, whilst the move by Harare to introduce a gold coin was warned against by the IMF, the recent talk of introducing a gold backed digital currency is another threat to the fiat dollar and is also politically significant. A lot of dynamics are at play in Zimbabwe, but for now, the biggest bet is on lithium.

Do you believe that lithium will play a leading role in reshaping the country’s economic fortunes or will it disappoint as was the case with Chiadzwa diamonds? Subscribe to omnizim.com and follow developments of interest to the country and beyond.